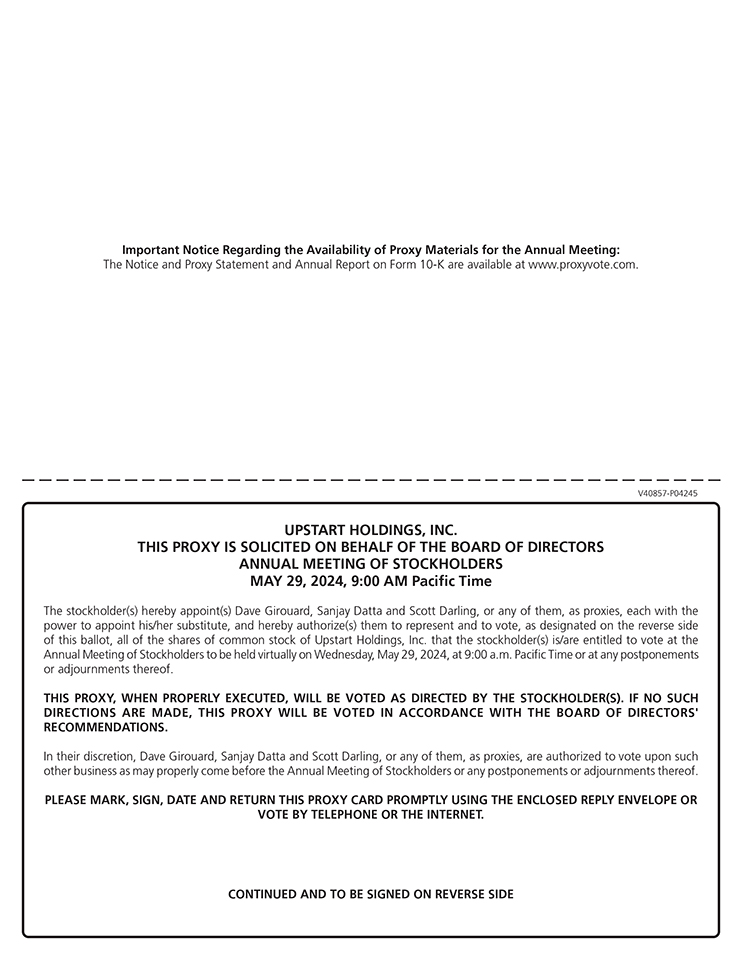

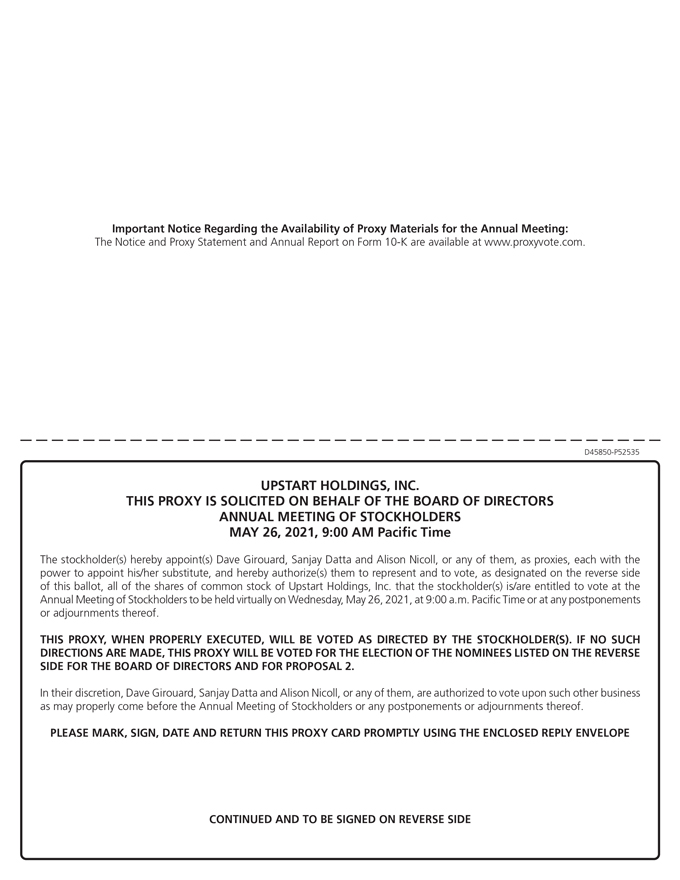

UPSTART HOLDINGS, INC.

NOTICE OF 20212024 ANNUAL MEETING OF STOCKHOLDERS

To be held at 9:00 a.m. Pacific Time on Wednesday, May 26, 202129, 2024

TO STOCKHOLDERS OF UPSTART HOLDINGS, INC.:

The 2021We are pleased to invite you to virtually attend the 2024 annual meeting of stockholders (the “2021“2024 Annual Meeting”) of Upstart Holdings, Inc., a Delaware corporation, which will be held virtually on Wednesday, May 26, 2021,29, 2024, at 9:00 a.m. Pacific Time. You may attend the 2021The 2024 Annual Meeting by visiting www.virtualshareholdermeeting.com/UPST2021, wherewill be held virtually via a live interactive audio webcast on the Internet. If you held shares of our common stock at the close of business on April 1, 2024, you will be able to listen tovote online and submit questions during the meeting live, submit questions and vote online.at www.virtualshareholdermeeting.com/UPST2024. We are holding the 20212024 Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement:

| 1. | to elect as Class I directors the |

| 2. | to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for |

| 3. | to approve, on an advisory basis, the compensation of our named executive officers; and |

| 4. | to transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Our board of directors recommends that you vote “FOR” the director nominees named in Proposal One and “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm as described in Proposal Two.

Our board of directorsBoard has fixed the close of business on April 1, 20212024 as the record date for the meeting. Only stockholders of record of our common stock on April 1, 20212024 are entitled to notice of, and to vote at, the 20212024 Annual Meeting. Our proxy statement contains further information regarding voting rights and the matters to be voted upon.

On or about April 14, 2021,5, 2024, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”), containing instructions on how to access our proxy statement for our annual meeting and our annual report to stockholders over the Internet. The Notice provides instructions on how to vote and includes instructions on how to receive a copy of our proxy materials and annual report by mail or e-mail. The Notice, our proxy statement and our annual report to stockholders can be accessed directly at the following Internet address: www.proxyvote.com, using the control number located on the Notice or, if you requested to receive a printed copy of the proxy materials, your accompanying proxy card.

Your vote is important. Whether or not you plan to attend the 20212024 Annual Meeting, we urge you to submit your vote as soon as possible to ensure your shares are represented. We encourage you to submit your proxy or voting instructions via the Internet, which is convenient, helps reduce the environmental impact of our annual meeting and saves us significant postage and processing costs. For instructions on voting, please refer to your proxy card, or the Notice or page 23 of the accompanying proxy statement.

We appreciate your continued support of, and continued interest in, Upstart.

By order of the Board of Directors,

Alison NicollScott Darling

General CounselChief Legal Officer and Corporate Secretary

San Mateo, California